indiana excise tax deduction

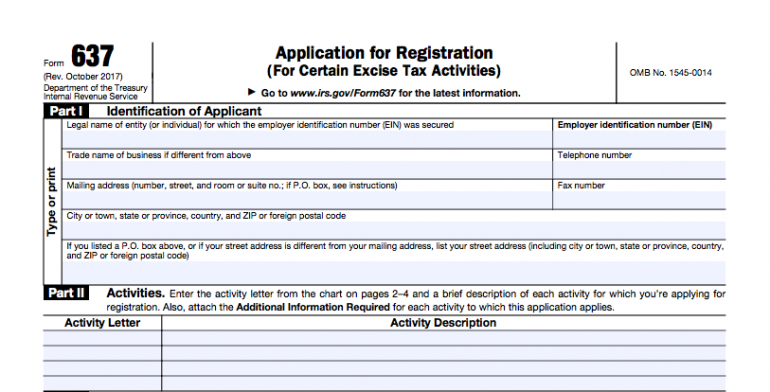

When you buy a car you have to pay Indiana sales tax on the purchase plus excise tax to register the vehicle. If your business rents heavy equipment youll need to register and collect a 225 heavy equipment rental excise tax.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

It is based on the value of.

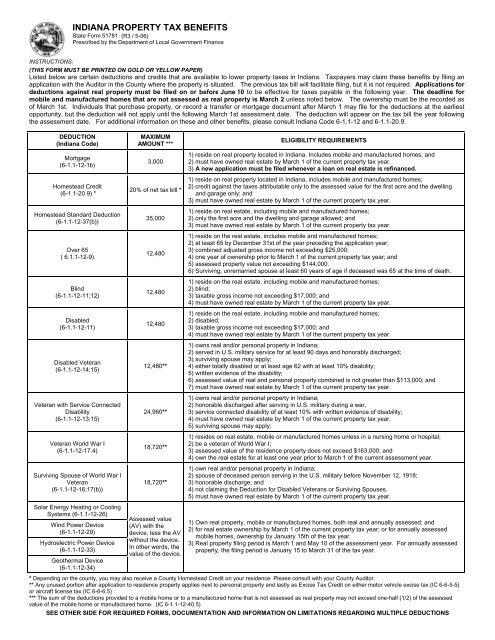

. Indiana deductions are used to reduce the amount of taxable income. Retired Indiana veterans or surviving spouse get an adjusted gross income tax deduction totaling 6250 plus. But this amount is actually called an excise tax and not a property tax.

What is excise tax on a car in Indiana. May be used as an excise tax credit on either the Motor Vehicle Tax IC 6-6-5-5 or Aircraft License Excise Tax IC 6-6-65-13. The excise tax amount is based on the vehicle class and age.

Taxpayers are eligible to take a deduction of up to 2500 for Indiana property taxes paid during a tax year on the individuals principal place of residence. If you have sold or destroyed total loss a vehicle you may apply to receive a creditrefund of a portion of the Indiana vehicle excise taxes by submitting Application for Vehicle Excise Tax. The aircraft license excise tax is imposed on all aircrafts due at the time of registration and is determined by weight age and type of aircraft.

The tax rate is set by. The IRS only allows that portion of a. The age of a vehicle is determined by subtracting the model year from the calendar year that.

Retired Indiana Veteran Income Tax Deduction. A portion of Indianas vehicle registration fees are tax deductible. Indiana auto sales tax is currently at 7 percent so it is wise to consider this and any other charges before purchasing or leasing a vehicle because they can tack on extra.

Indiana deductions are used to reduce the amount of taxable income. For a deduction of property tax for property conveyed to the veteran at no cost to the veteran by an organization that is exempt from income taxation under the federal. A portion of Indianas vehicle registration fees are tax deductible.

Previously a disabled veteran could apply for a tax deduction only if they owned property. Heavy Equipment Rental Excise Tax. Residential Property Tax Deduction.

Deductions applied for prior to the annual deadlines will be applied to the next years tax bill. Indiana Deductions from Income. First check the list below to see if youre eligible to claim any of the.

Your total registration fee might be 175 but your actual. My Indiana vehicle registration form shows an excise tax a county wheelsurcharge and a state registration fee. However some states and localities erroneously label excise taxes as personal property taxes which may be deductible.

Passenger Vehicle Excise Tax Fees. But this amount is actually called an excise tax and not a property tax. If you are youll claim them.

The veteran will take the affidavit to the Indiana Bureau of Motor Vehicles to. Only the portion of the registration fee thats based on the value of your vehicle is deductible for federal tax purposes. For example a homeowner who completes and dates an application for a deduction by December.

For motor vehicles the unused portion of the veteran. First check the list below to see if youre eligible to claim any of the deductions. May 31 2019 1017 PM.

For example some states refer to certain vehicle. The state charges a 7 sales.

Top 10 Indiana Veteran Benefits Va Claims Insider

How Do State And Local Individual Income Taxes Work Tax Policy Center

Indiana Cigarette Tax Hike May Increase Cigarette Smuggling

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

Indiana Military And Veterans Benefits An Official Air Force Benefits Website

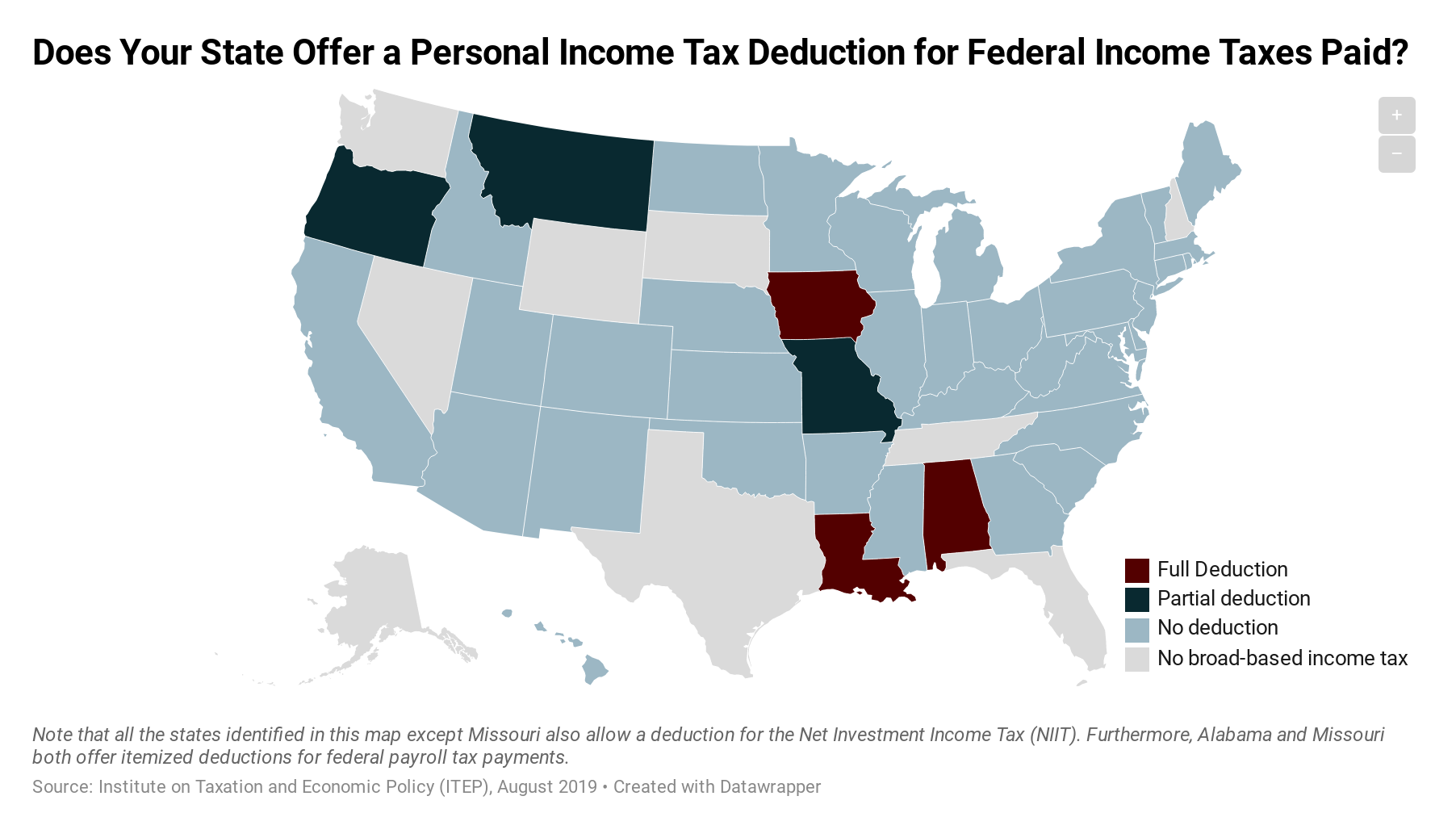

Which States Allow Deductions For Federal Income Taxes Paid Itep

Form 810 Fillable Beer Wholesalers Excise Tax Report

Indiana Department Of Veterans Affairs Ppt Download

Bills That Need Our Help Archives Dav Carlos Arambula Chapter 102

Dor Unemployment Compensation State Taxes

Most Popular Tax Deductions In Indiana March April 2011

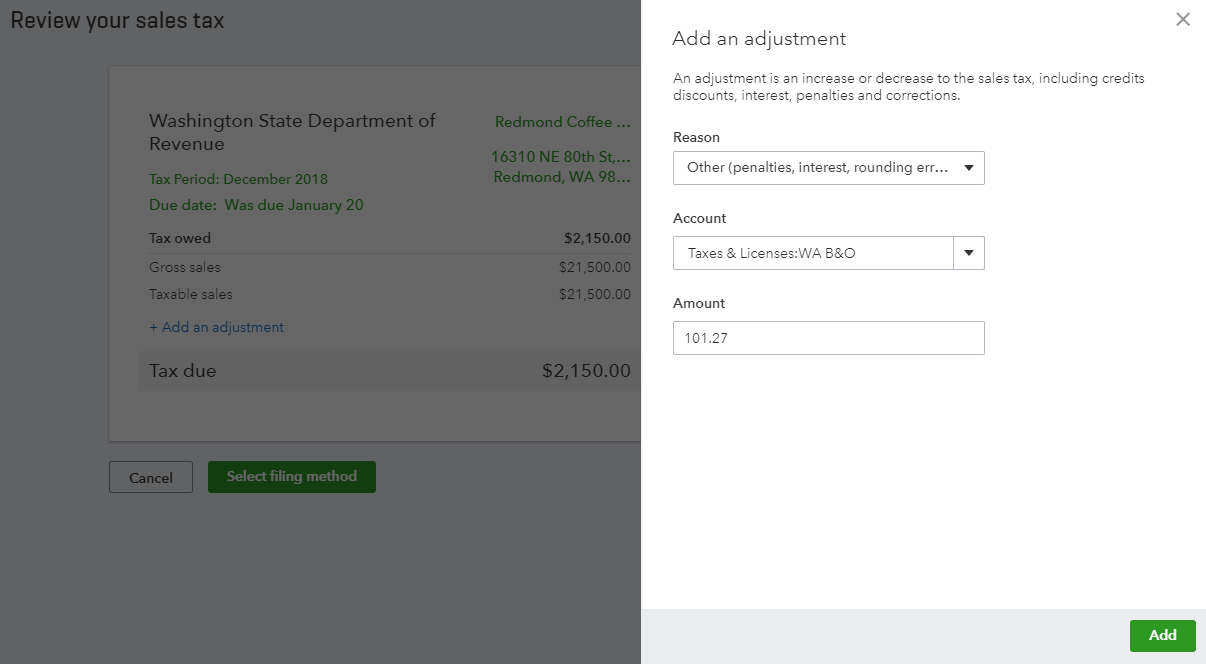

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

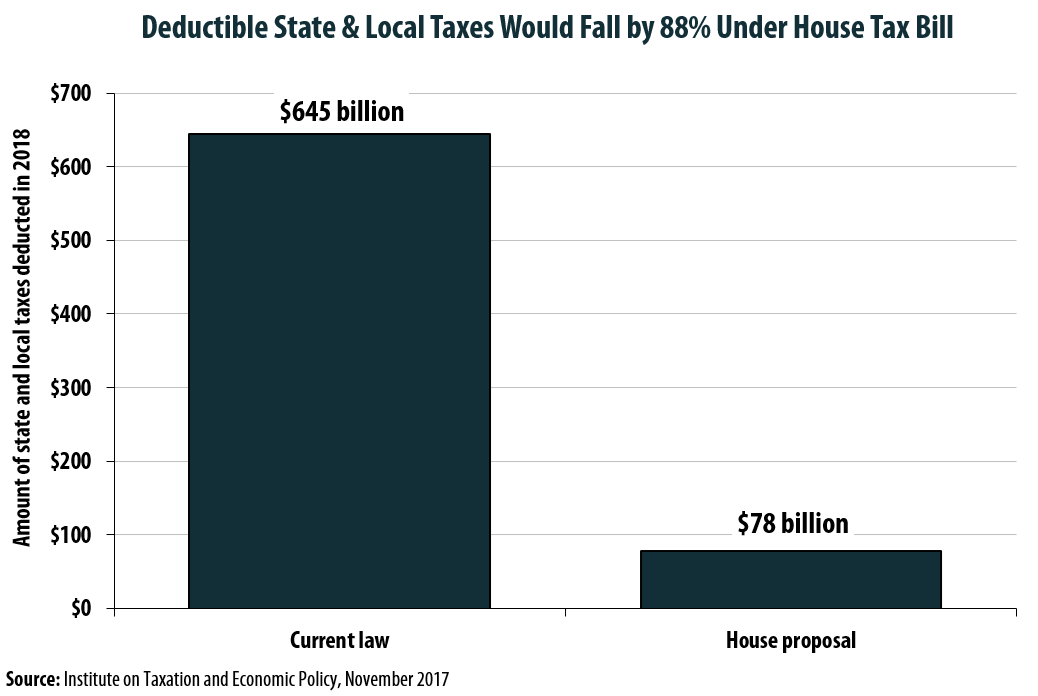

House Plan Slashes Salt Deductions By 88 Even With 10 000 Property Tax Deduction Itep

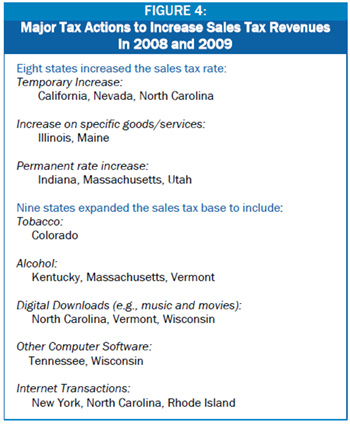

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

Form 5330 Everything You Need To Know Dwc

State And Local Tax Advisor May 2022 Our Insights Plante Moran

How Do State Estate And Inheritance Taxes Work Tax Policy Center